Why is Credit Score Important?

A credit score is one of the most critical financial indicators in an individual’s life. It’s a numerical expression that helps lenders, banks, and even credit card processors assess a person’s creditworthiness and financial stability. The importance of a good credit score cannot be overstated, as it directly affects your ability to secure loans, mortgages, credit cards, and sometimes even employment. A strong credit score can open doors to financial opportunities, while a poor score can limit your access to credit and increase borrowing costs.

In this article, we’ll explore what a credit score is, why it’s essential, how it affects your dealings with credit card processors, and strategies for building and maintaining a good score.

What is a Credit Score?

A credit score is a three-digit number that represents a person’s creditworthiness, calculated based on various factors such as payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries. The most commonly used credit scoring model is the FICO score, which ranges from 300 to 850. The higher the score, the better your creditworthiness is perceived.

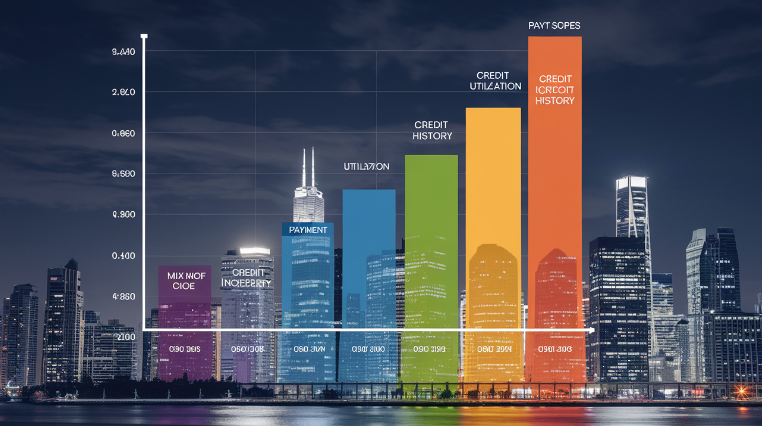

Here’s a breakdown of what contributes to your credit score:

- Payment History (35%): Whether you’ve paid past credit accounts on time.

- Credit Utilization (30%): The ratio of your current credit card balances to your total available credit.

- Length of Credit History (15%): How long your credit accounts have been active.

- New Credit (10%): The number of recent credit inquiries or newly opened accounts.

- Credit Mix (10%): The variety of credit accounts you have (e.g., credit cards, mortgages, loans).

Maintaining a high credit score allows you to access better financial products, lower interest rates, and more favorable loan terms.

Why is Credit Score Important?

A credit score is important for several reasons, as it affects various aspects of your financial life. Let’s dive into the core areas where your credit score has the most significant impact.

a. Loan Approvals

When you apply for a loan, whether it’s a personal loan, mortgage, or auto loan, the first thing lenders will check is your credit score. A good credit score signals to lenders that you are a responsible borrower who is likely to repay the loan on time. On the other hand, a low credit score may cause lenders to reject your application or charge you a higher interest rate to compensate for the perceived risk.

Lenders use credit scores to determine both your loan eligibility and the interest rates you’ll be offered. Borrowers with high credit scores typically qualify for lower interest rates, meaning they’ll pay less in interest over the life of the loan. This can make a significant difference, especially with large loans like mortgages, where even a small percentage point change in the interest rate can translate into thousands of dollars in savings.

b. Credit Card Approvals and Interest Rates

Credit card processors, such as those issuing Visa, MasterCard, or American Express cards, also rely heavily on your credit score when determining whether to approve your application. Credit card processors assess your risk by examining your credit score and credit history to determine the likelihood that you will make timely payments.

A higher credit score increases your chances of being approved for premium credit cards, which often offer lower interest rates, better rewards, and higher credit limits. Meanwhile, if you have a poor credit score, you might only qualify for credit cards with high annual percentage rates (APRs) or may need to secure a credit card with a deposit (secured credit cards).

Credit card processors, in turn, have an impact on the types of credit cards and terms offered to businesses. When businesses set up merchant accounts to process payments, credit card processors often evaluate the business owner’s credit score to determine the business’s risk profile. Low-risk businesses with owners that have good credit are likely to get better terms, lower transaction fees, and improved access to payment processing tools.

c. Access to Housing

Your credit score also plays a crucial role when you’re renting a home or applying for a mortgage. Landlords and property managers commonly review applicants’ credit scores to assess whether a tenant is financially responsible and likely to pay rent on time. A low credit score can result in your rental application being denied, or you might be asked to provide a larger security deposit upfront.

For homebuyers, a good credit score is essential to securing a mortgage. Mortgage lenders use credit scores to assess risk, with higher scores often leading to lower interest rates. With a low score, you might face challenges securing a mortgage or end up paying significantly higher interest rates, which can add tens of thousands of dollars in interest over the life of the loan.

d. Employment Opportunities

While not all employers check credit scores, some industries, especially those in finance, banking, and government, may review your credit report as part of the hiring process. Employers may view your credit history as an indicator of your financial responsibility, and a poor credit score could potentially hurt your chances of landing a job, particularly in positions where financial integrity is critical.

e. Insurance Premiums

Insurance companies also use credit-based insurance scores to determine premiums for auto, home, and other types of insurance. These scores are similar to credit scores but are used specifically by insurers to predict the likelihood of filing a claim. A higher credit score generally translates to lower insurance premiums, while a lower score may result in higher premiums, reflecting the insurer’s perception of greater financial risk.

How Credit Score Affects Businesses and Credit Card Processors

A credit score doesn’t just impact individuals. It also has significant implications for businesses, especially when they deal with credit card processors and merchant services providers. Here’s how credit score influences businesses in relation to payment processing:

a. Merchant Account Approval

When a business applies for a merchant account to process credit and debit card transactions, credit card processors will typically evaluate the business owner’s personal credit score. Merchant account providers view credit scores as an indicator of whether the business will be able to handle chargebacks, returns, and other risks associated with processing payments.

If a business owner has a low credit score, the credit card processor may either deny the application or approve it with more stringent terms, such as higher transaction fees or a rolling reserve (holding a percentage of the funds processed in case of disputes).

b. Transaction Fees

Credit card processors often determine the fees they charge based on the risk profile of the business. Businesses with owners who have excellent credit scores are considered lower-risk, which means they may qualify for lower processing fees. On the other hand, businesses with owners who have poor credit may face higher transaction fees due to the perceived increased risk.

c. Access to Business Credit and Loans

Businesses need access to credit for growth and expansion, whether it’s through business credit cards, lines of credit, or business loans. A business owner’s credit score plays a crucial role in determining their eligibility for these financial products. Just like personal loans, a higher credit score allows businesses to secure loans with more favorable terms and lower interest rates.

A business with a strong credit score is also in a better position to negotiate better terms with suppliers and service providers, which can improve cash flow and profitability.

Strategies to Improve and Maintain a Good Credit Score

Whether you’re managing personal finances or running a business, maintaining a good credit score is essential for long-term financial health. Here are some proven strategies to improve and maintain a good credit score:

a. Pay Bills on Time

Your payment history is the most significant factor in determining your credit score. Late or missed payments can have a substantial negative impact. Make sure to pay all your bills, including credit card payments, loans, and utilities, on time every month.

b. Keep Credit Utilization Low

Aim to keep your credit utilization ratio (the percentage of your available credit that you’re using) below 30%. For example, if your total credit limit across all cards is $10,000, try to keep your balance under $3,000. High credit utilization signals to lenders that you may be financially overextended, which can lower your score.

c. Limit New Credit Inquiries

Each time you apply for a new credit card or loan, a hard inquiry is made on your credit report, which can temporarily lower your credit score. Be mindful of how often you apply for new credit and only do so when necessary.

d. Diversify Your Credit Mix

Having a variety of credit types (such as credit cards, auto loans, and mortgages) can have a positive impact on your credit score. However, only take on new forms of credit if they align with your financial goals.

e. Review Your Credit Report Regularly

Regularly reviewing your credit report can help you spot errors or inaccuracies that could be hurting your credit score. If you find any discrepancies, dispute them with the credit bureau to have them corrected.

Conclusion: The Critical Role of Credit Scores in Financial Health

A credit score is much more than just a number—it’s a reflection of your financial history and behavior that influences every facet of your financial life. From securing loans to negotiating lower interest rates and accessing better credit card offers, maintaining a good credit score is essential for both individuals and businesses. For business owners, a strong credit score not only affects personal borrowing but also plays a crucial role in dealing with credit card processors and merchant services, influencing everything from approval rates to transaction fees.

By understanding the factors that affect your credit score and implementing strategies to improve it, you can position yourself or your business for long-term financial success.